Investment Highlights

We are one of the globally leading companies in the Photonics market, e.g. for

- Laser for retina treatment in ophthalmology,

- Laser perforation for airbag solutions,

- High-end micro optics for semiconductor equipment industry,

- Systems for red light and speed enforcement in traffic,

- Micro-optical OEM systems for life science applications

Our innovative solutions enable new cutting-edge products and make our customers more efficient, e.g.

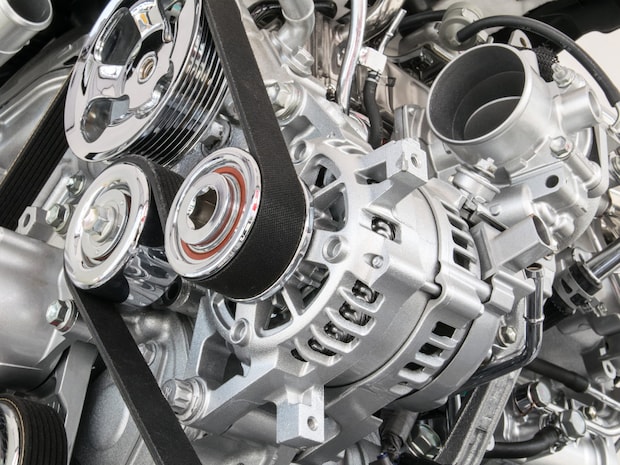

- with high-precision two- as well as three-dimensional optical metrology systems in the automotive and electronics industry,

- flexible, robot-based systems for three-dimensional laser material processing of complex geometric metal and plastic parts,

- highly-automated manufacturing systems.

We profit from sustainable trends in our target markets.

- Digital World: optical- and micro optical components and systems for semiconductor equipment industry.

- Health: medical lasers used as well as powerful digital imaging systems for new medical diagnostic applications.

- Mobility & Efficiency: products for quality assurance and optimized production processes, in particular in the automotive industry.

- Infrastructure: systems for red light and speed enforcement, systems for toll monitoring, number plate recognition as well as Traffic Service Providing (TSP).

- Security: complex energy systems with leading power density for military and civil vehicles.

Jenoptik is opening up new and exciting growth opportunities through further internationalization.

- The Group is generating already more than 70 percent of revenue abroad.

- January 2019: Reorganization of the business structure in Asia completed.

- August 2018: Acquisition of Prodomax Automation, Barrie, Ontario (Canada).

- January 2018: Opening of an application center in the Silicon Valley, USA.

Financially, Jenoptik is well positioned in the long term and shows solid organic growth.

- Jenoptik has a sound balance sheet structure as well as a comfortable equity ratio of almost 60 percent.

- In addition, the solid asset position and a viable financing structure give the company sufficient scope for acquisitions.